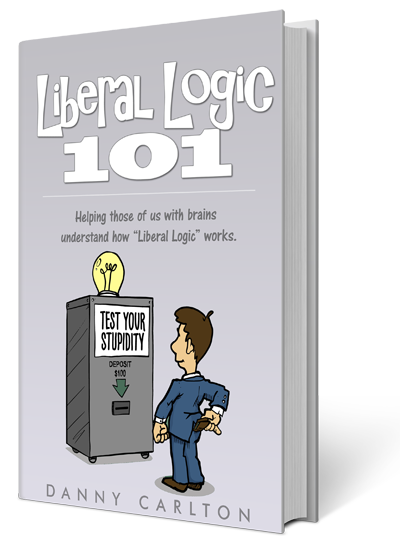

Yes! The book is finally here!

You enjoyed the memes. You laughed at the jokes. You shared the humor. Now find it all, plus a lot more in the Official Liberal Logic: 101 ebook!

In the book you'll find a guide to the history of Modern Liberalism, how it formed, why it formed and why Liberal Logic has become the warped, insane, illogical nonsense we see and laugh at today.

Available at the following fine retailers...